Wealthy choose to stretch their dollar — particularly when living in Las Vegas, NV

According to real estate data, Las Vegas recorded its highest number of US$1 million-plus sales in the first quarter of 2023. Median home sale prices were around US$415,000 for the same time period, after peaking in 2022 at US$482,000. To put this in perspective, the median sales price for a home in Los Angeles was around US$980,000 in 2023.

“The value of the dollar stretches considerably farther in Las Vegas,” explained Las Vegas real estate agent Melissa Tomastik in a recent Hollywood Reporter interview. “Several of our clients have expressed that their real estate investment in Las Vegas equates to what they would have otherwise allocated toward taxes.”

Other celebrities now living in Las Vegas include Oscar De La Hoya, who purchased a US$14.5 million mansion in Henderson, NV in 2022, as well as Celine Dion, who recently sold her Summit Club estate for US$30 million but kept her US$5 million home in Lake Las Vegas, NV, according to Hollywood Reporter.

Las Vegas isn’t the only hotspot for the rich and famous. According to a 2023 study released by SmartAsset, a US-based financial advisory firm, young, wealthy Americans are opting for homes in Florida, Texas and New Jersey, with a smaller number opting to relocate to Colorado, Connecticut and North Carolina.

A few factors may factor into this exodus from traditional high-net-worth (HNW) strongholds — such as New York and Malibu — to newer lux-communities, like Las Vegas. Here are three of the biggest reasons.

Reason 1: Save on taxes

One big reason to move is to save on taxes. Only nine states in the U.S. don’t charge income tax — and Nevada is one, along with Florida and Texas.

Compare that to California, where the highest wage earners pay 13.3% in state income tax — the highest in the nation, according to research conducted by the Tax Foundation organization, based on analysis of IRS documents.

Even state sales tax is lower in many of these new lux strongholds. For instance, according to the Tax Foundation, Nevada’s average state sales tax rate is 8.23%, slightly less than California’s 8.82% state sales tax.

Homeowners leaving California will also avoid the state’s new Measure ULA (United to House LA) tax, commonly called the “Mansion Tax.” Levied on any property sale exceeding US$5 million, this new tax requires property sellers to pay a 4% surcharge to the state. If the property sale price exceeds US$10 million, this surcharge jumps to 5.5%.

Property owners in certain regions of Canada also need to contend with additional taxes. For instance, anyone buying a home in the City of Toronto must pay municipal Land Transfer Tax (LTT) in addition to provincial LTT. Foreign nationals who own Canadian property as well as certain Canadian owners, such as corporations or trustees, need to pay the federal Underused Housing Tax (UHT) — a surcharge of 1% on the property’s value.

Reason 2: Better business opportunities

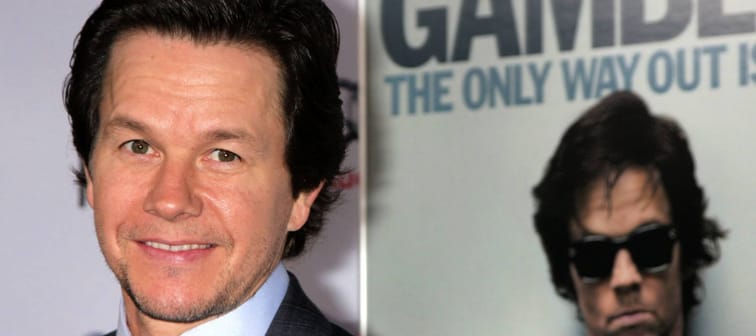

For HNW entrepreneurs — including Mark Walhberg, who plans to build a film studio near his Las Vegas home — Nevada and other lower-cost-of-living states appear to offer better business opportunities.

According to Tax Foundation research, Nevada is in the top 10 states with a friendly “state business tax climate” compared to California’s rank at number 48.

Reason 3: Lower cost of living

To get ahead — or keep more of what they have — many wealthy Americans are paying attention to the recent increase in the cost of living.

According to a 2022 study by the Commerce Department’s Bureau of Economic Analysis, Texas’s average cost of living was just over US$45,000 — US$8,000 less than California’s and New York’s.

California, New York (and even Alaska, Hawaii, Colorado and the state of Washington) rank highest in cost of living. States like Nevada, Texas, North and South Carolina and Ohio boast moderate living expenditure averages, with Idaho, New Mexico and Louisiana offering the lowest cost of living on average.

Don't Miss

- Keep more of what you make! Find the best tax software to help you maximize deductions and find tax credits

- Cost of living is still high in 2024. To help find savings, use a budgeting app

- Not sure where to start when it comes to investing? Don't let analysis paralysis stop you — use a robo-advisor instead

3 takeaways from the rich and famous

Minimize housing costs

Even though celebrities like Dion and Wahlberg are buying multi-million dollar estates, that doesn’t mean they aren’t looking to reduce their living costs — and it starts with the cost of housing.

In Canada, it pays to investigate what properties in neighbouring communities and municipalities cost, particularly if the commute is manageable or you can negotiate work-from-home perks with your employer. And don’t forget to shop for the best mortgage rates and terms.

Consider working with an independent mortgage broker like Homewise to make it easy. As a national digital brokerage, Homewise works with dozens of lenders to negotiate the best mortgage deal on your behalf. It takes just five minutes to create your free profile and you get access to the Homewise affordability calculator, or chat with mortgage experts, find lower-cost insurance options and connect with knowledgeable real estate lawyers or agents — all of which help make buying a home simple and easy.

Minimize taxes

It appears Wahlberg made the decision to fund his professional goals — of building a film studio in Nevada — when he moved to Las Vegas. He earned a profit on selling his California home and avoided paying additional taxes (such as higher state taxes or levies tacked on to expensive properties).

In Canada, the key is to maximize legitimate deductions and never pay for services you can get for free. For those looking to minimize taxes and increase savings, consider filing your taxes for free. Popular brands, such as H&R Block, let you file your taxes for free, while TurboTax offers free guides and calculators to help you maximize your savings.

Invest wisely

The basic foundation for amassing wealth is to spend less than you earn, but it can be easy to spend without a savings plan. For Canadians looking to get started, one easy option is to automate your savings plan. For instance, Wealthsimple lets you set up an an investing account that takes your initial deposit — minimum of $500 — and builds a low-fee personalized portfolio. Better still, this automatic account reinvests your dividends and rebalances your portfolio — helping to keep your savings on track. New customers get a $25 bonus after opening and funding their account. Wealthsimple also offers accounts for crypto trading and stock investors.

For those interested in more specialized investments — particularly those that let you dangle your toes in the lifestyles of the rich and famous — there are options such as fine wine investments, investing in top-notch whiskey, or owning a share in artistic masterpieces.

While most financial experts wouldn’t suggest investing in these specialized assets as part of your core investment strategy, the luxury collectible market can be an interesting way to learn and earn from your investments.

One option is to buy shares in masterpieces by acclaimed artists such as Banksy, Money, and Warhol using a share platform such as Masterworks.

According to Citi Global Art Market, the contemporary art asset class outperformed the S&P 500 by 174% between 1995 and 2020. Apparently, fine art can be a great way to diversify a portfolio.

Designed specifically for investing in contemporary artwork, Masterworks is open to retail and accredited investors across North America. Even with the global reach — and the ability to keep the investment tax-efficient — investors should consider the risks before investing. For more information, sign up for a free account at Masterworks.

Bottom line

Even if Canadian homebuyers don’t plan to shop in the luxury real estate market, the rationale for why some rich and famous people are leaving communities with high housing costs can’t be denied. Tax savings, more affordable housing, and access to big city amenities without the crime and commute are good reasons to consider buying in a community outside the real estate hot spots.